Why talk about business in the context of medicine?

Business structures are the most common way of organising the flow of patients, the systems and equipment that is needed to care for them, the care team and the money that pays for it all.

Business structures are the most common way of organising the flow of patients, the systems and equipment that is needed to care for them, the care team and the money that pays for it all.

Differences to businesses in other sectors:

- Health care businesses are socialised businesses

- Australia’s healthcare system is funding-dependent (due to Medicare)

- This dependency on funding applies to the whole sector - even those parts that are run as businesses

Similarities to businesses in other sectors:

- Complex chain of getting products/services from the supplier (clinicians) to the customer (patients)

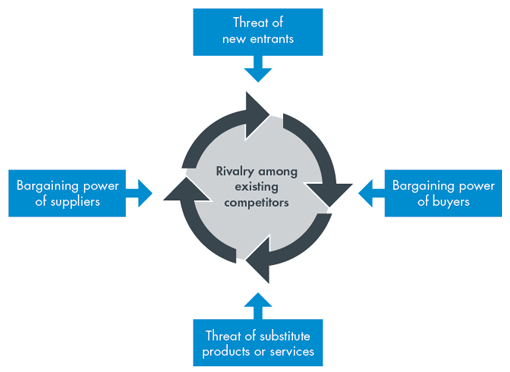

Porter's 5 forces analysis

Click on each of the boxes in the diagram to find out more.

1. Threat of new entrants: establishing a new GP practice is as easy as hanging out a shingle with the exception that you need to have a medical qualification and provider number.

This restricts new entrants more than in most other sectors. However, technology and changing patient expectations could change the foundations of general practice care more quickly than we might think…so nothing is assured long-term.

2. Bargaining power of buyers: many patients use the MBS as a signal about what healthcare should cost. In bulk billing environments, the patient is separated from the cost of the service.

3. Threat of substitutes: GP care can be replaced by non-VR doctors, specialist physicians, some nursing activities and functions of allied health.

4. Bargaining power of suppliers: private health insurers have recently started making moves into primary care.

5. Rivalry among existing competitors

Business structures

General practices can be run as either:

General practices can be run as either:

- Unincorporated businesses

- Sole trader

Sole trader: An individual who runs a business in their own name.

- Partnerships

Partnerships: One or more persons in business together with a common view to profit. Partnerships are usually formed via a partnership agreement, which sets out how conflicts will be managed, partners admitted and the relationships dissolved.

- Associateship

Associateship: Two or more independent doctors agree to share facilities and expenses. No profit sharing or joint goodwill is created in the association. Prices charged for services must also be set independently to avoid accusations of collusion.

- Assistantship

Assistantship: Doctors can be sub-contracted and included in a business via an assistantship agreement. The agreement needs to clearly define how the relationship will work so that the doctor is not deemed to be an employee by the ATO.

- Sole trader

- Incorporated businesses

- Company

Company: A registered entity under Australian Corporations Law. Companies are legal entities discrete from their founders. For this reason founders can protect their liability to their share of capital invested in the company.

A company is often mostly suited to larger medical practices. In many cases incorporated medical practices are run for the benefit of shareholders who are not themselves medical practitioners.

- Trust

A trust is a very historic business format where trustees (can be an individual or company) carry on business activity for the benefit of others (beneficiaries). Frequently, trusts are used to hold assets which are then leased to incorporated medical practices or involved in partnerships.

- Company

Management structures

Self-management by owner

Some practices are owned and managed by the practice principle or practice partners. They usually hire spouses or partners to do the basic management tasks under their direction.

This model requires the doctor/s in charge to take considerable time each week to attend to business management decisions. It also means the onus is on them to stay up to date with legislative, funding and other changes in the business environment.

They need to be exceptionally competent with financial matters, team development and systems to ensure they run an efficient and effective operation which satisfies staff and patients.

Management structures

Professional management

Some practice owners hire practice managers to undertake most management functions.

- The Australian General Practice Network used to recommend one full-time practice manager to each five full-time doctors

- Practice managers brief the owners

- Owners make the strategic decisions at semi-regular board-like meetings

- The practice managers then implement these decisions

Disadvantages:

- Owners may not have the knowledge to make well-informed decisions

- Owners can be drawn into operational matters which have been delegated to the practice manager

- Poorly-paid practice managers working with uninformed supervision can be tempted to commit fraud or work within systems where fraud can occur through others

It is becoming increasingly common for professional practice managers to have a component of their package related to profitability and growth targets. Many are even part of the ownership group.

Management structures

Outsourced management

This involves hiring professional management groups to undertake tasks such as payroll, accounts, rostering, staff management, purchasing consumables, managing IT and submitting compliance paperwork.

This model ensures practice owners get the right people and right skills when they need them.

Outsourced management can occur in even very small practices through contractual agreements with external groups.

In the case of large corporate medical centres, the outsourced management effectively creates a central 'corporate management' group that takes a margin from each site to pay for a head office.

Operating costs involved in different management structures

- Most practices use option B shown below (i.e. hire professional practice managers)

- Note that costs can vary according to location and circumstance

- Gross profit needs to be at least 40% to cover these costs.

- Therefore maximum splits of 60% or less are the only sustainable business model.

| A. Self-management | B. Professional practice managers | C. Outsourced management |

|---|---|---|

Owner: up to 15 hrs/wk Bookkeeper: 5 hrs/wk Accountant IT Support: 2 hrs/wk Senior receptionist: 30 hrs/wk |

Practice manager: Owner: up to 6 hrs/wk Bookkeeper: 3-5 hrs/wk Accountant IT Support: 2 hrs/wk |

Outsourced company: Accountant Senior receptionist: 30 hrs/wk |

Strategy: Business goals and business model (the WHY)

Business strategy can be assessed by asking the 'Why' questions:

Business strategy can be assessed by asking the 'Why' questions:

- Why do you want to work in general practice?

- Why are you motivated to do what you do?

The business strategy of the Virtual Practice is to:

- Employ doctors at a reasonable income

- Enable doctors to provide care

Systems: Business rules and operating environment (the HOW)

Having a clear business strategy will give you clues about the systems and business rules you should establish.

Having a clear business strategy will give you clues about the systems and business rules you should establish.

For example - if your 'why' is to provide hope to the hopeless, you will probably find yourself attracted to working in palliative care, mental health, infectious disease or with the disadvantaged. This will typically lead to business rules like:

- Spending a minimum of 15 mins with patients

- Bulk billing everything

- Building mental health provision into your care team

- Allowing time for case review and debriefing

- Recalling patients more regularly to monitor their chronic conditions

- Building strong bridges with community organisations in your area

People (the WHAT)

Being clear about your 'why' is the best way of:

Being clear about your 'why' is the best way of:

- Motivating people

- Making it easy for everyone to make decisions without supervision

- Focusing everyone on the same tasks

- Fostering harmony at work

- Attracting more good people when you need them

- Consistently delivering on your promise to patients

Always hire for a passion for the goals you share and the values you live by and train for skills if you need to.

Getting organisation across the team so clarity is achieved in relation to what everyone is supposed to do is critical.

Why it's important to differentiate your practice

- With growing numbers of GPs, it is no longer unique to 'hang out a shingle' and start practicing

- If you are no different to anyone else all you are supplying is a commodity - Commodity products like wheat and coal are at the mercy of price taking.

- With few price signals in the market because of Medicare, patients see GPs as a fairly uniform bunch

- Patients will keep moving from bulk billing doctor to doctor

- This in part reflects the great information asymmetry seen in healthcare - a patient doesn't necessarily have the knowledge to assess the doctor's clinical skills and thus judges the doctor on their friendliness, the ease of parking or the reception staff

Patients and demand

- What is the profile of patients within the practice?

- How does that differ from the general community around the practice?

- How does that differ from other practices nearby?

- What capacity exists to accept new patients?

- What sorts of patients seem to be in need of care?

- What is an acceptable wait time to appointment in this catchment?

- What is the current wait time to appointment?

Strategic imperatives

- Why was this practice created?

- What is the big 'why' for this group of clinicians/owners?

- What makes this practice stand out from the crowd?

- What does this practice need to deliver to continue to offer an acceptable return to its stakeholders/investors?

Operations

Practice Structure:

- Which legal and operational structure will underpin the quality of service and financial viability dictated by stakeholders?

- How is management performed around here?

- Is this practice part of a larger whole?

GP Relationships:

- How many GPs are required to cover overheads given the floor space?

- Are the GPs owners, contractors or employees?

- What specialisations do the GPs have?

- Will this be a teaching practice?

Practice Administration:

- Will any of the GPs lead the practice?

- Given the number of GPs and their style of work, what management is required?

- What ratio of reception to GPs given the number and nature of patients?

- What ratio of nurses to GPs?

- What clinical governance model will be used?

Information Technology & Communications

- How electronic and networked will the practice be?

- How many devices need to talk to each other eg medical devices to patient systems?

- What sort of IT infrastructure and back-up is required?

- Will medical records be available in multiple locations?

- Will a bring your own device or home access policy be supported?

- Will patients be able to access resources or bookings online?

- Will an online community be fostered? Social networking?

- What clinical and administrative systems will be used?

Patient flow:

- How many patients will be seen per hour?

- Will the practice be bulk, mixed or private billing?

- Will the practice support chronic disease management and procedural activity?

- What cancellation, reminder and “no show” systems will be instituted?

- How will patients be linked to pharmacy, allied health, pathology and specialty providers?

Outcomes

Quality:

- Will the practice be accredited?

- Will the practice emphasise evidence based medicine?

- Systems to link quality practice, shared protocols and clinical governance?

- Patient satisfaction surveys?

- 360 degree feedback systems?

- Relationships with Primary Healthcare Networks, hospitals, universities and other stakeholders?

Financial:

- % of revenue from chronic disease care?

- Required gross profit margin to meet budget?

- Retained earnings % per year?

- Distributions to owners?

- Use of incentives to influence performance?

- Transparency of finances to the team?

Influencing factors

Workforce constraints

GPs:

- Average age of practitioners

- Availability of new GPs in the area

- Work/life expectations of GPs in the area

- Remuneration expectations of GPs

- Length of service

Other staff:

- Availability of nurses and allied health in the area

- Work/life expectations of the core team

- Understanding of team care

- Willingness to take responsibility for contributing to patient care

- Remuneration expectations of clinical and non-clinical staff

- Turnover rates

Influencing factors

Revenue control

- Returns arre dictated by patient numbers and average revenue per patient

- Face to face contact with patients (AGPN recommends 4.8 FTE medical reception staff for 5 GPs)

- Will appointments be taken or will patients be required to wait to minimise down time from 'no shows'?

- Focussing on chronic disease, mental health and preventative health work attracts incentives and higher revenue MBS items

Influencing factors

Patient profile

- Age of patients and prevalence of chronic disease

- Number of patients who are on low incomes or pensions

- Burden of disease in the area e.g. mental health, disability, sexual health, substance abuse?

- Number of patients with private insurance

- Number of patients from remote areas

- Number of patients from CALD backgrounds

Influencing factors

Community setting

- What is the footprint of healthcare coordination and advocacy groups in your catchment?

- Which other healthcare providers work in the area?

- Which social services support people in the area?

- How enmeshed is the community?

- What level of health awareness exists in the community?

- Who advocates for health and healthcare innovation?

Influencing factors

Government policy

- What changes to Medicare are being touted?

- What is happening with private healthcare?

- What is happening with public hospitals?

- What is happening with residential aged care?

- What is expected of GPs in terms of registration and currency?

- What workforce solutions are being encouraged?

- How will electronic health records change in the future?

Ecosystem of healthcare participants

Primary Healthcare Networks

Primary Healthcare Networks (PHNs) replaced Medicare Locals on 1 July 2015. PHNs receive funding from the Commonwealth to:

- Identify healthcare gaps in the region

- Coordinate responses to priority care needs (e.g. refugee health or mental health)

- Promote prevention and public health agendas

- Liaise between different levels of care

- Provide professional development

Ecosystem of healthcare participants

Divisions of General Practice (and Medicare Locals)

Divisions of General Practice came about in the 1990s in response to the fragmentation of primary care and the need to organise GPs' responses to changes in technology and government policy.

They were funded by the Commonwealth to provide regional data, professional development, support for rolling out new business systems and advocacy.

Divisions still exist in some regions, however, with the advent of Medicare Locals they were defunded by the Commonwealth in an attempt to broaden the participation in primary healthcare planning and delivery to groups outside of medicine.

Ecosystem of healthcare participants

Colleges (RACGP)

- The various clinical colleges exist to:

- Self-regulate various medical disciplines

- Oversee accreditation and training programs

- Advocate for their members

- Provide professional development and

- Generate solutions which advance the cause of the profession

- The RACGP has funded the development of the GP Sidebar to assist GPs filter information of relevance to particular patients. They also funded the development of the PenCAT tool to help practices interrogate their patient databases. Various manuals and kits are also produced by the college on a regular basis.

- RACGP also provides submissions to the various Ministers for Health and is vocal in media debate about healthcare.

Ecosystem of healthcare participants

Community Health activities

- State Government Health Departments fund an array of community health activities

- Changes to funding models mean that these activities are increasingly directed towards support hospital avoidance programs, chronic disease care and child and maternal health challenges

- It is expected that more and more community health activities will be outsourced to private providers in the future

Ecosystem of healthcare participants

Public health

- Public health remains a central platform to the delivery of an effective healthcare system

- Public health branches provide services as broad as food safety monitoring to dengue management and oversight of measles outbreaks

- In an increasingly globalised world, public health officials have an increasing role to play in pandemic planning and responses to epidemics like obesity related diseases

- A wide variety of patient education materials and vaccines are coordinated through public health agencies

Things to consider before determining a new doctor's split

1. How does money come in to the practice?

- General practice revenue is linked to the patients you serve

- Most patients are attached to a Medicare opportunity

- Medicare rebates have been frozen until 2018

- You will generally be paid on revenue received rather than billings

- It can take time for Medicare, DVA, Work Cover and legal related claims to come through the system

2. How will your income/expenses change over time?

- Business costs will rise, however, Medicare rebates will remain frozen until 2018

3. Will your gross profit cover the practice's operational costs over the long-term?

Insurance payments

- Work Cover and other employee insurance-related groups often require considerable documentation that can be taxing to assemble

- Create a separate fee schedule (i.e. market rates) for insurance groups as they have different payment options to Medicare

- Charge for the time it takes to:

- assemble the information and

- the cost of transmission

- Create a schedule of costs for both GPs and administrative support

- Charge for incidentials such as photocopying (it's not uncommon for practices to charge between 25 and 45 cents per page)

Tracking doctor billings

- Every biller to Medicare is personally responsible for their billing

- Access or ask for a full report on billings each week.

- This can ensure speedy rectification of inaccurate billings

- The list will also show the real % of patients you bulk bill vs. any private billings you generate

- It also useful to extrapolate billings to revenue per doctor hour and compare this to a practice average

- A list of new patients per week and 'Did not Attend' by doctor, also provide insight into spare capacity now and into the future

- Some practices provide a list to doctors each week of their billings. Most practice management software systems will allow doctors to generate this for themselves so if it is not provided, it is definitely worth tracking down.

- More advanced practices can provide reports showing billings against targets or even aggregated against practice budgets. They may also provide details on waiting times, no shows and other pertinent data like outstanding results. See these examples - 'Doctor last week' and 'Administration dashboard'

- Doctors with poor revenue and limited patient retention will find it difficult to cover the costs of running a clinical room and may be asked to take a cut in their revenue split or hourly rate.

- Doctors who demand a 70/30 split would need to have extraordinary pulling power with an established group of mixed billing patients to even be affordable in most general practices

The difference between cash flow and income

- Cash flow and profits are often confused

- Simply having money in the bank does not mean the funds are surplus

- Funds have to cover expenses, BAS, superannuation and other periodic bills

- Most businesses have high-expense months when insurances and other large bills are paid

- High-expense months require cash reserves to draw on to keep the business afloat

- Most general practices will need at least $60-$100K in working capital to ensure they can keep operating during the months when expenses exceed income

- Quarterly payments of Practice Incentive Payments (PIP) make managing cash flow even more critical:

- Many practices are heavily reliant on PIP to fund their nurses

- Nurses are generally paid fortnightly in advance but PIP monies are paid quarterly in arrears

Business owner drawings

Before business owners draw income from their companies they should:

- Remember that some income and many bills tend to cluster in just a few months of the year

- Amortise large expenses such as insurance and superannuation

- Prepare monthly accounts to determine liabilities and how much cash in their account is really available

Preventing Medicare fraud

Effective management of finances reduces the likelihood of Medicare fraud

- Most practices have separate systems for:

- Medicare billings

- Patient records

- Accounting data

- The existence of these separate systems creates opportunity for fraud

- It is comparatively easy to bill Medicare for an item but never have that revenue land in the operating statement or the right bank account

- Monthly reconciliations of Medicare billing, bank statements and statements of revenue in the accounts should always be sighted by at least two people

- Doctors should also receive regular statements of billings so that they can check their use of the MBS schedule and reconcile their income against their activity

- Medicare is becoming increasingly vigilant about over-use of its funding system so doctors and practices should monitor levels of activity, accuracy of billing and ensure patients sign to acknowledge receipt of service

Practice Incentive Program (PIP)

- Practice incentive payments are based on what the practice has achieved (e.g. number of pap smears) multiplied by the percentage of care you provide to each patient multiplied by a fixed price

- PIP is an increasing area of revenue for accredited practices

- Incentives are paid quarterly

- Not all practices choose to participate – some believe the costs of accreditation outweigh the incentive revenue

- To receive the incentives, each doctor needs to sign paperwork for Medicare

- The scope and focus of the incentives changes to address policy issues (designed to stimulate behaviour change in general practice)

- Benchmarks can be changed once certain targets are achieved (e.g. the pap smear incentive payment target was lifted from 65% of eligible women to 70% in 2013)

- PIP is a billion dollar expense for Medicare each year

Standardised whole patient equivalents (SWPEs)

- SWPEs reward practices that provide ALL of their patients' care

- SWPEs are calculated every 18 months using retrospective patient data

- The SWPE value of a practice is the sum of the fractions of care provided to practice patients, weighted for the age and gender of each patient

- Older patients might be worth 2 SWPEs but younger patients might only be worth 0.5

- SWPEs can be split between two practices that both see a patient

- E.g. a practice has 21870 SWPEs but is only paid on 1856 because some of the patients sought care elsewhere

- A practice's number of SWPEs changes each quarter (as some patients leave and others join the practice)

What are the different PIP types?

Diabetes Incentive

- Aims to provide earlier diagnosis and effective management of people with established diabetes mellitus

- Paid if at least 50% of practice patients diagnosed with diabetes have received an annual cycle of care and more than 2% of your practice patients have been diagnosed with diabetes (assessed by HBa1C collection)

Cervical Screening Incentive

- Aims to encourage screening of under-screened women (i.e. women aged between 20 and 69 years who have not had a cervical smear in the last four years), for cervical cancer and to increase overall screening rates

- Paid if at least 70% of females aged 20-69 have had a screen over the last 30 months

Other PIP incentives include:

- Asthma Incentive

- After Hours Incentive

- eHealth Incentive

- GP Aged Care Access Incentive

- Indigenous Health Incentive

Other incentives

Workforce Incentive Program (WIP)

- Payment is based on SWPEs multiplied by the number of hours of nursing available, factored by EN and RN rates

Service Incentive Payments (SIP)

- SIPs reward the adoption of evidence based systems of care or prevention

- Annual cycles of care are the reward mechanism used by the commonwealth to support completion of all the elements of care for more complex conditions like diabetes and asthma

- Immunisation and attendance at residential aged care facilities have also been supported through the SIP mechanism

Disbursement of payments

- Disbursement of incentive payments varies between practices

- Many practices keep all incentive payments, especially those that relate to practice nurses

- Provide data to your team on compliance rates

- Ensuring your team members receive a benefit will support both better care and more revenue

Strategic tasks

- Patient interface:

- booking

- billing

- recalling

- Clinical services and care coordination:

- medical

- nursing

- allied health

- Clinical interface:

- software

- clinical libraries

- protocols

- Medicare

- governance

- consumables

- room hire for allied health

- brochures

Administrative tasks

- Marketing:

- surveys

- complaints

- new services

- growing patient base

- signage

- marketing collateral

- website

- Human resources:

- rosters

- team meetings

- leave

- appointments

- payroll

- professional development

- registrations

- performance management

- teaching paperwork

- Legal:

- leases

- sub-contractor and partnership agreements

- warranties

- Reporting:

- accounting and banking

- performance data and benchmarks

- after-hours claims

- teaching logs

- SIP & PIP

- board meetings

- Systems:

- accreditation

- ICT

- archives

- ordering and equipment maintenance

- cleaning and WH&S

- debtors

Incidents of fraud

- Fraud in Australia is estimated to cost $15 billion per year

- Typically fraud occurs through:

- Staff taking money or siphoning funds

- Bills being paid for which no items were received

- Systems being targeted resulting in interruption to service

- Self-managed super funds being stripped of assets

- Overseas crime syndicates are increasingly targeting small practices for fraud

- These attacks can result in a high cost of:

- ICT contractors restoring systems

- Advising all patients of the potential for loss of data

- Lost days of clinical activity and potentially lost patients

- Paying a ‘release’ fee to the crime syndicates is usually attractive as it pales in comparison to these high reparation costs

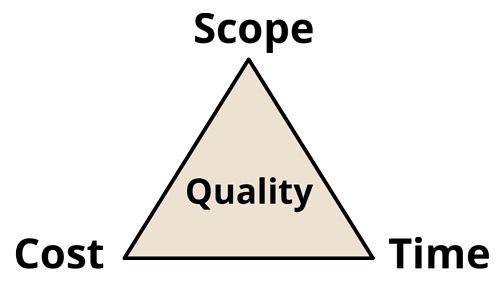

Trade-offs between time, cost and scope

Delivery is a trade-off between time, cost and extent of output.

You can always achieve one, often two, but almost never three of these things.

This affects the quality of the output.

- We need facilitate patient and revenue flow to delivery timely and effective care in a sustainable way

- This requires real expertise or else you risk alienating patients and antagonising your team

Economies of scale

- Whilst larger businesses have specialist sub-sections (e.g. HR or a finance department) general practices are usually managed by generalist staff.

- Most practices are time-poor and don't produce monthly accounts or use trend analysis to manage their cash flow

- This leads to:

- Poor cash control (i.e. lost income from investments that could be made on surplus cash)

- Becoming a potential target for fraud

- Limited real profitability growth year on year (productivity growth is flat)

- Higher turnover, which adds another cost to the business

- Most general practices are more complex businesses than most other businesses in the country

Keep on top of changes to Medicare

- Assign a team member to be the ‘Medicare expert’ and reference point

- Offer a nominal sum e.g. $1,000 - $5,000 per year

- The expert should keep abreast of changes to Medicare and advise the other staff

- Have team discussions about the application of the schedule to different cases

- Investigate systems and staff that are required to deliver the desired care as efficiently as possible

Other risks a practice manager should monitor

- Staffing – key staff losses, mistakes, excess of hours available which need to be paid for, excess leave building up, injuries

- Clinical activity – poor triage, inattention to patients, missed recalls, missed screens, cold chain/vaccine issues, sterility, needle sticks, patient privacy, social networking, pandemics, patient consents

- Billing – incorrect billing, inadequate billing, changes to MBS, fraud

- Patients – “stealing” by old staff & competitors, bad behaviour, non-compliance

- Presence – loss of lease/building, branding, media activity

- Systems – loss of accreditation/changes to standards, IT security or failure

- Loss – theft, loss of intellectual property

- Cash – default by large payers e.g. asylum seeker support agencies, WorkCover, fraud, changes to Medicare including introduction of a co-payment

Identify, assess and manage these risks

There are simple things you can do to keep your patients and clinicians safe:

There are simple things you can do to keep your patients and clinicians safe:

- Set up and maintain a risk register

- Keep up with legislation changes

E.g. recent changes to workplace health and safety, privacy and bullying - Have a complaints process in place

- Encourage patient and colleague feedback

E.g. a staff member who is poor at building rapport is more likely to be subject to litigation - Have an open, accountable and safety-focused work culture

- Conduct near-miss meetings

- Do clinical audits on other colleagues to compare results

- Agree on common protocols for grand rounds meetings

- Use clinical and financial software to generate relevant data

Insurance is a very common form of risk mitigation, however, even if you have insurance you still need to manage risk — if the insurer can show you did not follow reasonable steps, you can be left exposed.

How health trends are increasing pressure on general practice

Health care is increasingly being asked to account for itself.

Health care is increasingly being asked to account for itself.

This scrutiny is entirely novel. In addition, new equipment, new categories of worker and new mechanisms for providing healthcare are creating options for substitution of care.

The reality is that medicine is facing the sharpest declines in real incomes it has ever seen.

This means that pressure in sectors like general practice, which have even less of a mystique than professional cousins in surgery, is rising. Maintaining the status quo is almost a lost battle.

The real question in such changing times is how to minimise the fall? What can you do to improve your chances of building business success in primary care in such a changeable and price-contained market?

How should practice managers and owners respond to changes in the health sector?

Change fatigue is endemic in healthcare. This is especially true for health professionals who wear more than one hat (e.g. as both a provider and a practice manager).

Change fatigue is endemic in healthcare. This is especially true for health professionals who wear more than one hat (e.g. as both a provider and a practice manager).

- Anticipating and responding to health trends is often resisted

- Attending to business realities is seen as a waste of resources

- Management is seen as taking time away from patient care

- Managing a business is a crucial part of any business

- Being a clinician and a manager go hand in hand

- Business owners can accrue many benefits if they work “on” not just “in” their businesses (reference Gerber)

- Use a tool such as PESTE to stay tuned for changes in any key areas

- P: Political

- E: Economic

- S: Social

- T: Technological

- E: Environmental

- Complete a SWOT Analysis to determine which changes should be incorporated into your business strategy

- S: Strengths

Things in your favour as a business - W: Weaknesses

Things which can bleed cash, create conflict, reduce flexibility and take energy away from the group - O: Opportunities

Things which could happen and present potential to your business - T: Threats

Note: Strengths can become threats if the business is too reliant on a person or source of income. - Force Field Assessment

- Determine whether your strengths and weaknesses are a driving or restraining force

- Undertaking this assessment at least every year or at most two years

- Be responsive to demands

- With healthcare costs being one of the largest expenditure items for government and a significant proportion of household income, demands for change will come from both patients and funders

- Test your assumptions and key into the knowledge and experience base of others on the team

Fill the dead spots in the diary

- Recall patients for surgery, chronic disease or annual screening

- Reduce the charge-out rate for these slots

- Ensure that late afternoon slots are saved for premium-priced services in the future

Practice sustainability

- Patient numbers fluctuate due to:

- Seasonal ebbs and flows (e.g. flu season)

- The ease of online bookings and the power of web-based rating systems

- Insurer-driven referrals

- Avoid the loss of patients to other providers by:

- Creating diary blocks for walk-ins, urgent care and complex care

Note - Mondays, Fridays and out-of-hours slots are usually easy to fill - Avoid excessive appointment waiting times

- Performing effective patient handovers

- Using case conferencing to manage complex patients

- Managing staff loads (i.e. FT, PT, casual) to cater for fluctuations

- Monitoring patient satisfaction

- Generate internal service standards

- Integrate the efforts of the entire care team:

- Work effectively with allied health professionals

- Consider working in premises with or partnering with mental health and allied health teams

The move from hospital care to general practice

- Hospitals are already focussed on their NEAT targets (National Emergency Admission Target) via reliance on Commonwealth funding

- Hospitals and insurers are increasingly focussed on avoidable admissions

- There are incentives for GPs to see patients in the community in an attempt to avoid time in emergency departments (the average cost of an ED bed is $2000 per day)

- Australians living in rural areas wait much longer to see their preferred GP than those in metropolitan areas (Medicine in Australia, Balancing Employment and Life (MABEL) survey)

- Other players (such as Telstra) are entering the healthcare market targeting these gaps in provision

Adding specialty services

Long wait times for hospitals create an opportunity to provide additional chronic disease or speciality services to your community:

Long wait times for hospitals create an opportunity to provide additional chronic disease or speciality services to your community:

- The emergence of “skin cancer clinics” has been one response to the excessive waits for dermatology review in public hospitals

- Other groups have chosen to create specialty diabetes clinics to overcome delays receiving Endocrine Review

- Such services can be via referrals GP to GP or via patient response to marketing and brand positioning

Business failures

When do general practices fail as businesses?

When do general practices fail as businesses?

- Insular thinking:

- Management, profitability and growth are not given enough focus

- Complacency due to historical well-funded nature of medicine

- Not sensing changes to the environment

- Lack of external focus and willingness to respond

- Political, economic and social pressures:

- Lack of adaptation

- Lack of innovation

- Unmet expectations:

- Demands of managing the venture outweigh the returns

- Not following clinical best practice:

- Litigation

- Wasting resources (e.g. ordering unnecessary tests)

- Financial mismanagement

- Not growing revenue or containing costs

- Insufficient surplus revenue to reinvest in the business or deal with the unexpected